Financial planning for salaried employees is more than simply a driving procedure; it is a basic need for every individual and his or her family.

It is a full cycle that begins with a monthly budget and ends with retirement planning.Budgeting, Insurance, Goal-Based Investments, Debt Reduction, and Retirement are all part of the process. The cycle will be incomplete if any of these phases are skipped.

Many financial planners (experts) are emerging in the finance industry and on social media. However, the purpose of this post is to persuade you to consider changing your habits in order to achieve financial independence. Let us go through each step one by one.

Budgeting Monthly – 1st Step in Financial Planning for Salaried Employees

Financial planning is meaningless without the initial step of creating a monthly budget.

According to a poll, many salaried employees are unaware of their average monthly cost. Therefore, if you fall into this category, please make an effort to better your situation and adhere to a monthly budget.

Budgets should be kept in notebooks or diaries. As you write manually in a notebook, it absorbs your brain and constantly reminds you of where you spend the most money. Once you’ve identified the location of the majority of your expenses, simply look for ways to eliminate them.

Sort and classify your expenditures into three groups. They are as follows:

- Needs

- Desires

- Savings

Needs are the expenses we spend for essential items or things without which we cannot exist.

Wants are expenses that have no impact on your life if they are not spent or purchased.

Savings are deposits or investments made with a set percentage of one’s monthly income in order to meet financial goals or needs in later life.Rational financial planning is spending simply on necessities and saving between 30% and 50% of total monthly income.

Also read- Are social security benefits a form of socialism

Smartly manage your debt

Debt management may eat up a large portion of your earnings. Loans may need to be repaid by more loans. If it spirals out of control, you may be trapped in debt. Your life goals may be postponed, and possibly your retirement.

Planning your debt repayment might keep you out of problems. All you need is to know who you owe money to. Make a plan to pay them off. If you have a lot of debt, pay off the most expensive first.

Credit cards are the most costly loans. Pay down your credit card debt as soon as your salary is credited each month. Paying the minimal sum is a trap. Sooner or later, the interest will eat up all your money. Use your credit card only in an emergency.

Debt should be a last resort. Make as much of a deposit as you can. If you have large loans, consider a balance transfer. You can refinance your loan with a lower interest rate. This strategy saves a lot of money in interest.

Never borrow for depreciating assets. Personal loans and other tax-inefficient loans should be avoided at all costs. You can save and create a corpus to achieve your goals. This manner, you can avoid debt trap.

Develop your own investment strategy.

This is a critical component of financial planning. Once you begin saving, it must generate some revenue. You should understand what inflation is. In 2020, Rs. 100 in 1960 will be worth just Rs. 2.This is the definition of inflation. If your money does not increase, it will be eroded by inflation and eventually lose value.

Thus, you must invest your funds in any commodity that may generate a return that outperforms inflation over the long run. Meanwhile, you should comprehend why you are investing in the first place.Investing without a purpose is pointless. As a result, you should educate yourself about goal-based investing.

Investments are truly fueled by objectives. You will have a cause to forego today’s pleasures in order to make many decades pleasurable.

Numerous investment firms are offered, ranging from bank savings accounts and post office savings to Fixed Income components such as bonds, debt funds, mutual funds, gold, real estate, and stocks.It is not necessary to invest in high-yielding material; rather, it is critical to invest according to your objectives.

Creating Plans for Retirement

Retirement planning is critical for everyone. You are more vulnerable to diseases such as diabetes, hypertension, and heart attacks if you lead a sedentary lifestyle. Healthcare prices continue to rise year after year. Without a social safety net, you must have your own finances to cover all of these obligations.

As is the case with many others, you may believe that it is premature to begin planning now. At this rate, you begin retirement planning late and accumulate less than you could if you began earlier. This occurs as a result of the “magic of compounding.” It permits you to retire early and live a carefree existence.

While planning for retirement, several details must be clarified, such as the age at which you wish to retire. Additionally, estimate the amount of money you will require each month to cover your post-retirement expenses.

Conclusion

I hope this post will serve as an eye-opener on the topic of financial planning for salaried employees, as well as the actions to take in order to develop a robust plan.Make the necessary preparations and begin monthly budgeting as soon as possible

Following that, you should consider insuring your family, paying off all of your obligations, using goal-based investment, and saving for retirement.

Why do I Need to Have Financial Planning?

An organised strategy to managing one’s spending and savings that benefits the person over the long term is known as financial planning. Financial planning is important for a number of reasons.

How much of my salary should I save?

Savings should be at least 20% of your income. Another 50% should go to essentials, while 30% should go to optional things. The 50/30/20 rule is a simple approach to budget your money.

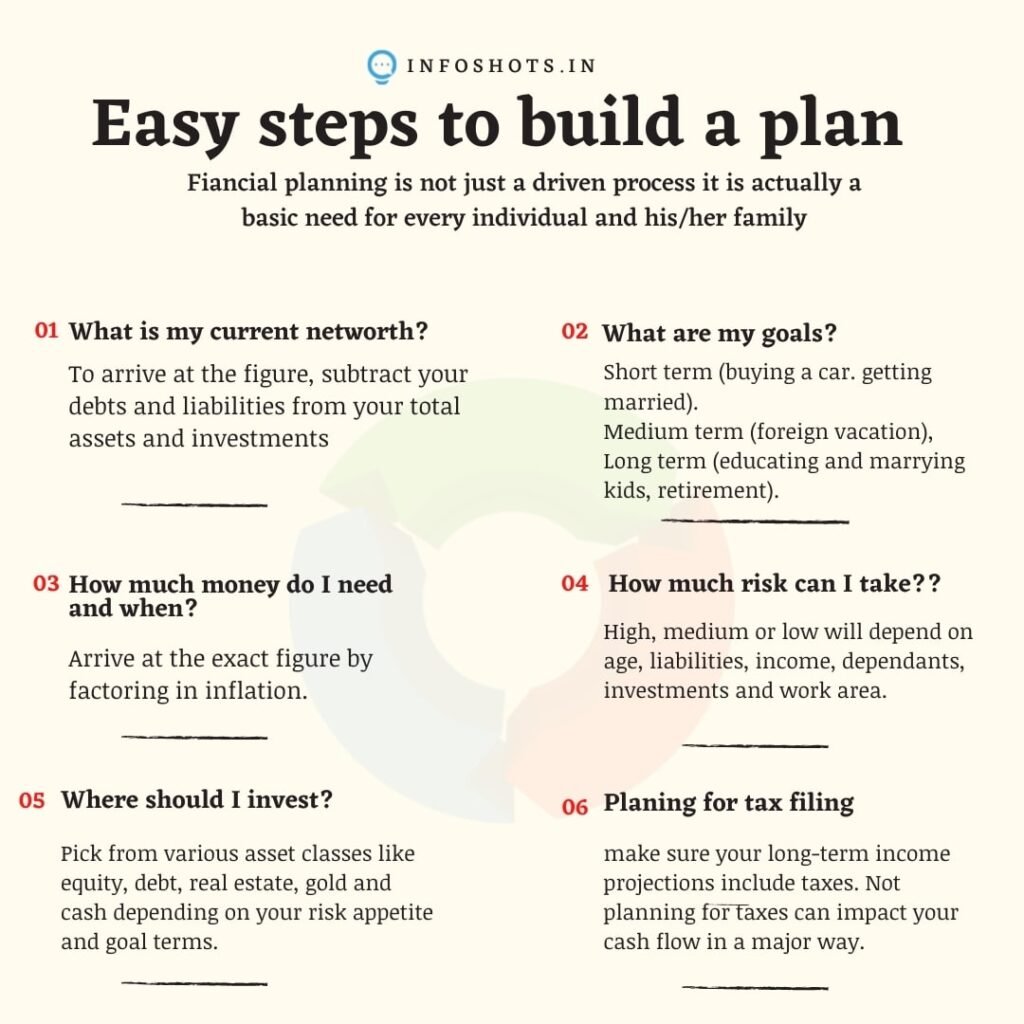

What are the steps in financial planning?

1 Analyze your present financial condition.

2 Setting financial objectives.

3 determining other ways of action

4 assessing alternatives

5 developing and carrying out a financial action plan, and

6 Carefully considering and modifying the plan

Disclaimer: The writers’ views are stated in this publication. They do not represent the views of infoshots or its members. infoshots does not offer any view about the legal status of any company, country, area, or territory, or its authorities. Read our Terms of Service and Privacy Policy here. Please contact us at contactinfoshots.in@gmail.com if you have any questions.

![RBI Approved Loan Apps in India: The Best Options for Instant Loans [Updated 2024] Best Options for Instant Loans 2023](https://infoshots.in/wp-content/uploads/2023/05/RBI-Approved-Loan-Apps-in-India.png)