Paytm is an Indian multinational technology firm located in Noida, India, that specialises in digital payment systems, e-commerce, and finance. The business was founded in 2006 by Vijay Shekhar Sharma, founder, chairman and CEO. All The Details You Need To Know about paytm IPO

Introduction

Did you know that the Rs.1.1 trillion digital payments market of India is very small compared to other countries? By 2020 the digital payments market of India is expected to grow to around $100 billion. India has been a very important market for Paytm.

In 2012 Paytm launched in India and within few years has become one of the largest online and mobile payments company in India. Today Paytm is one of the leading payments wallet companies in India. Its business also includes its online and mobile marketplace eBay, ticketing website BookMyShow, entertainment service Saavn, and a student discount portal called MakeM

The paytm IPO lauch date

Paytm on the announcement of its IPO, estimated the “roughly Rs 1500 crore” at its headquarters in the eastern city of Noida. The announcement was made by CEO Vijay Shekhar Sharma, who is an IIT graduate and founder of the company.

Paytm’s IPO is expected to see 10% of its paid up capital with it being around $300 million. Paytm plans to list it very likely by October this year. However, it would not be a domestic listing with about 40% of its shares going to overseas investors and the rest reserved for the public. However, if the price of Paytm IPO’s is at or around $10 billion, this would make it the biggest IPO in India.

Also read How To Get a Game-Changing Startup Idea

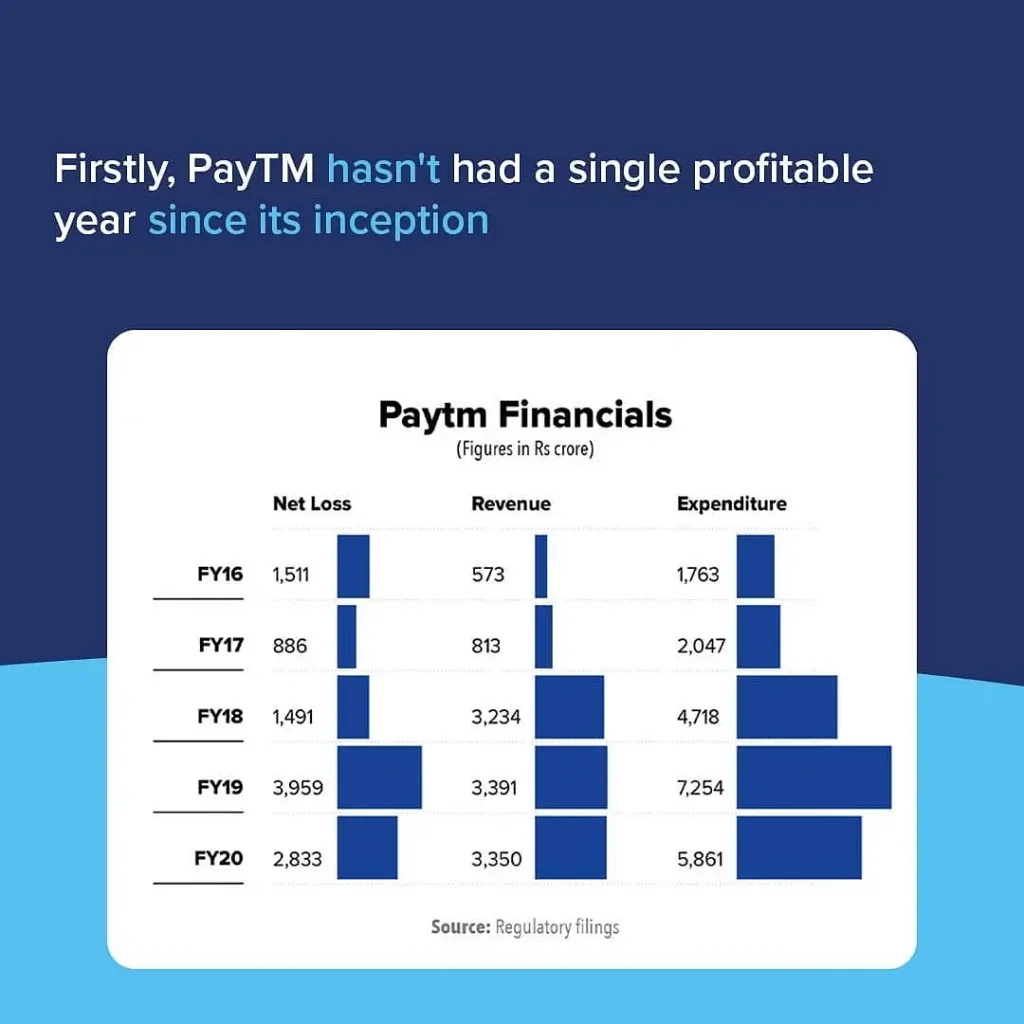

Financials of paytm

The company is reportedly generating 2 billion transactions a month, and making gross merchandise volume of $20 billion. Paytm Money business began in February 2016. Pricing of Paytm IPO Paytm is expected to go public in early 2021. The company is targeting a total valuation of about $10 billion after the IPO. The firm will be capitalized by selling up to 85 million shares to investors. Post listing the firm will have to pay taxes of about $780 million on the $1 billion of its gross revenue. Paytm is working with a few banks to handle its IPO.

Paytm’s Payments Bank is a financial institution.

According to the official Paytm website, Paytm Payments Bank is one of the largest private sector banks in India. It’s is a fully operational bank and has 2 million customers. The bank also offers other financial services such as fixed deposits, insurance, credit cards and mutual fund investments.

The company says it is one of the fastest growing bank in India. The Delhi based payments bank says that over 900,000 new customers are joining Paytm every day. In less than a year Paytm Payments Bank has crossed 700 million customer base. It is committed to serve more than 300 million Indians in the country. Paytm has already introduced its payments bank subsidiary in Nepal.

Subsidiaries

Paytm’s parent company One97 Communications is a technology company based in Delhi, India. The company develops and operates mobile payments systems like Paytm wallet, Payment Gateways and P2P money transfer. It has also started a payments bank that offers a suite of banking services to its customers. In 2016 it acquired PayU. India’s top mobile wallet .

What will happen when Paytm release its IPO?

The Paytm IPO was delayed for the last two years, it will go public in 2021. The Paytm IPO will be called Paytm (RBI) and will list in the Indian market. The listing will take place on the NYSE and the BSE. It will have a significant impact on the Indian financial market, since nearly every Indian bank is a partner of Paytm Payments Bank. It plans to offer banking services to millions of consumers in India by 2020. The company has raised $1.4 billion from investors in total and is valued at $9.3 billion as of January.

Conclusion

Paytm raises an impressive amount of money in the online payment sector. The Paytm IPO 2021 looks attractive.

https://norgerx.com/brand-viagra-norge.html

The company has a market cap of about $12 billion. The Paytm IPO was created to raise some $1 billion. The India e-payments startup has raised about $1.4 billion to date. In January, Paytm had pulled in about $600 million in its latest funding round, led by China’s Alibaba Group Holding Ltd. and SoftBank Group Corp. It has a market cap of $9 billion.

Paytm has over 400 million users and the startup also offers products such as movies, games, and mobile recharges, while it plans to foray into lending and banking. One of its main competitors is the Government of India-backed a payments bank to bring banking services to India’s one-billion-plus unbanked population.

The company, based in Noida, offers digital payments and financial technology. In 2021 Paytm release its Paytm IPO. payment can be made by QR code in 11 Indian languages at grocery stores, fruit and vegetable shops, restaurants, hotels, pharmacies, and even at educational institutions and parking lots. A $10 billion valuation was given to Paytm in January 2018.

It says it is able to accept payments directly into merchant accounts through its QR code systems in India. More than 20 million merchants use the system across the country. Recently Paytm is try to release its Paytm IPO. The company was founded by Vijay Shekhar Sharma in 2011 and has some well-known investors such as Softbank, Alibaba Group, and SAIF Partners. In January 2018, it raised around $3 billion from Softbank.

“Our mission is to bring financial services to 250 million Indians who do not have access to formal financial services through our mobile wallet app”. Our solution is simple – connecting the unbanked population to the formal financial ecosystem through our QR code based payment solution,” said Vijay Shekhar Sharma, founder, chairman and CEO, Paytm.